Last updated:

August 30, 2024 09:31 EDT

Author

Share

Fact Checked by

Last updated:

August 30, 2024 09:31 EDT

We believe in full transparency with our readers. Some of our content includes affiliate links, and we may earn a commission through these partnerships.

Berachain is a new EVM-compatible network with a three-token ecosystem. This includes BERA (transaction fees and staking), BGT (governance) and HONEY (stablecoin).

Those engaging in Berachain’s testnet environment could be eligible for free airdrop tokens, distributed in BERA. This guide explains how to participate in the Berachain airdrop. Read on for tips, strategies, and best practices to maximize your BERA rewards.

What Is Berachain?

Berachain is a new blockchain network that leverages the EVM (Ethereum Virtual Machine) standard. It has developed a unique consensus mechanism called “Proof of Liquidity.” In a nutshell, this means liquidity providers double up as network validators. This keeps the Berachain network safe while rewarding those who actively contribute.

Berachain is also gearing up for the Web 3.0 era, with a range of DeFi (decentralized finance) tools integrated into its network. This includes automated market makers (AMM) for decentralized token swaps. Not to mention perpetual futures and staking pools. What’s more, Berachain is compatible with the Ethereum framework.

This means it supports ERC-20 tokens and smart contracts. Another unique aspect of Berachain is its three-token ecosystem. BERA tokens will be used for transaction fees and staking. BGT is the network’s governance token. They’re only available when providing liquidity and can be redeemed 1:1 for BERA.

HONEY – artificially pegged to the US dollar, is Berachain’s native stablecoin. Now, it’s important to note that Berachain is currently in the “testnet” phase. This means none of its three tokens have been launched to the public. Instead, users can access testnet versions of each token, allowing anyone to engage with Berachain’s ecosystem risk-free.

Crucially, this will likely be the eligibility criteria for the Berachain airdrop. Put otherwise, tasks like swapping, minting, and providing liquidity will be rewarded. The airdrop campaign will distribute BERA tokens, although no official date has been announced. The best practice is to start engaging with the testnet today. This will allow you to maximize your potential rewards.

It’s important to note that the Berachain airdrop requirements are open for interpretation. This is because Berachain hasn’t officially released details about eligibility. Let alone when the BERA tokens will be distributed. However, the consensus is that Berachain will airdrop tokens based on network contribution. This means engaging with its testnet ecosystem.

So, multiple tasks can be completed, allowing you to maximize your potential BERA rewards. Best of all, there is no need to risk any money. This is because Berachain has adopted a “faucet” system, allowing participants to claim BERA periodically. This can be claimed with four different providers – each has its own faucet payouts and time frame (e.g., 1 BERA every 3 hours).

Those BERA tokens are only compatible with the Berachain testnet environment, so they can’t be withdrawn or traded. Nonetheless, each completed task will likely increase the airdrop allocation. Some of the tasks include swapping BERA for HONEY and other ecosystem tokens. Participants can also add BERA to liquidity pools.

Lending, borrowing, and NFT minting tasks are also available. Some tasks are associated with Berachain’s governance model, too. For example, participants can delegate BGT tokens to network validators. The best strategy is to claim BERA from the faucet as often as practically possible, and then complete as many different tasks as you can.

How to Be Eligible for the Berachain Airdrop

This section takes a much closer look at the Berachain airdrop. We discuss each testnet task in great detail, giving you the best chance of maximizing the potential rewards. No prior knowledge is assumed, ensuring the airdrop is suitable for beginners and seasoned pros alike.

Step 1 – Get the MetaMask Wallet and Add Berachain

You’ll need a suitable wallet before starting the airdrop tasks. One of the best crypto wallets is MetaMask. It’s free, secure, and compatible with all Berachain dApps (decentralized applications). Visit the MetaMask website and download MetaMask to your preferred device. You can choose from the browser extension or mobile app.

Open MetaMask and create a new wallet. Ideally, this wallet should be used exclusively for the Berachain airdrop, as tracking and monitoring your progress will be easier. Choose a strong password and write the 12-word backup passphrase on a sheet of paper. Keep that paper somewhere safe and private.

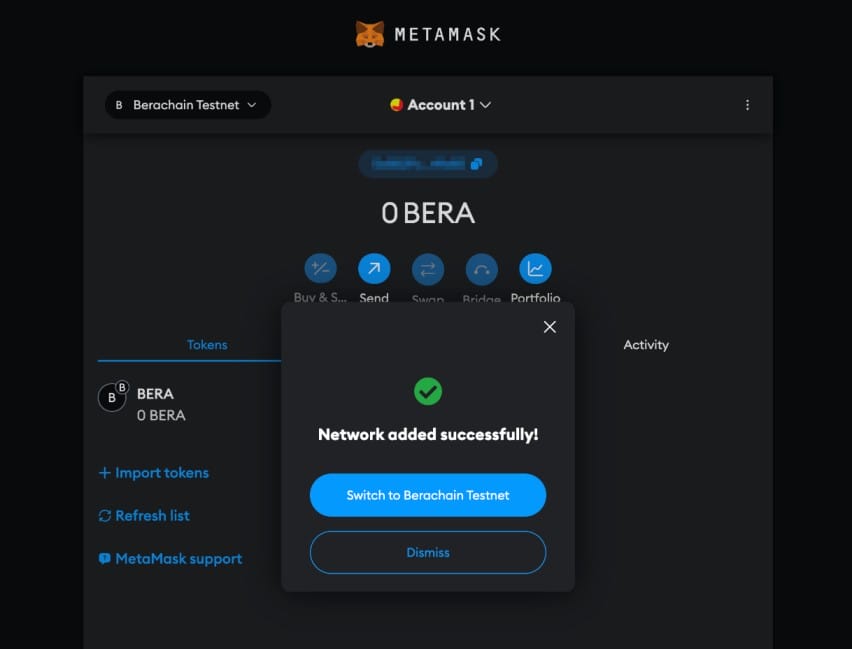

MetaMask comes as an Ethereum wallet by default. This means you need to manually add the Berachain network to MetaMask. Click the “Ethereum Mainnet” box next to “Account 1.” Then click “Add Network” followed by “Add Network Manually.”

Copy and paste the following network data:

Finally, click the “Save” button. Berachain should now show as an active network on MetaMask.

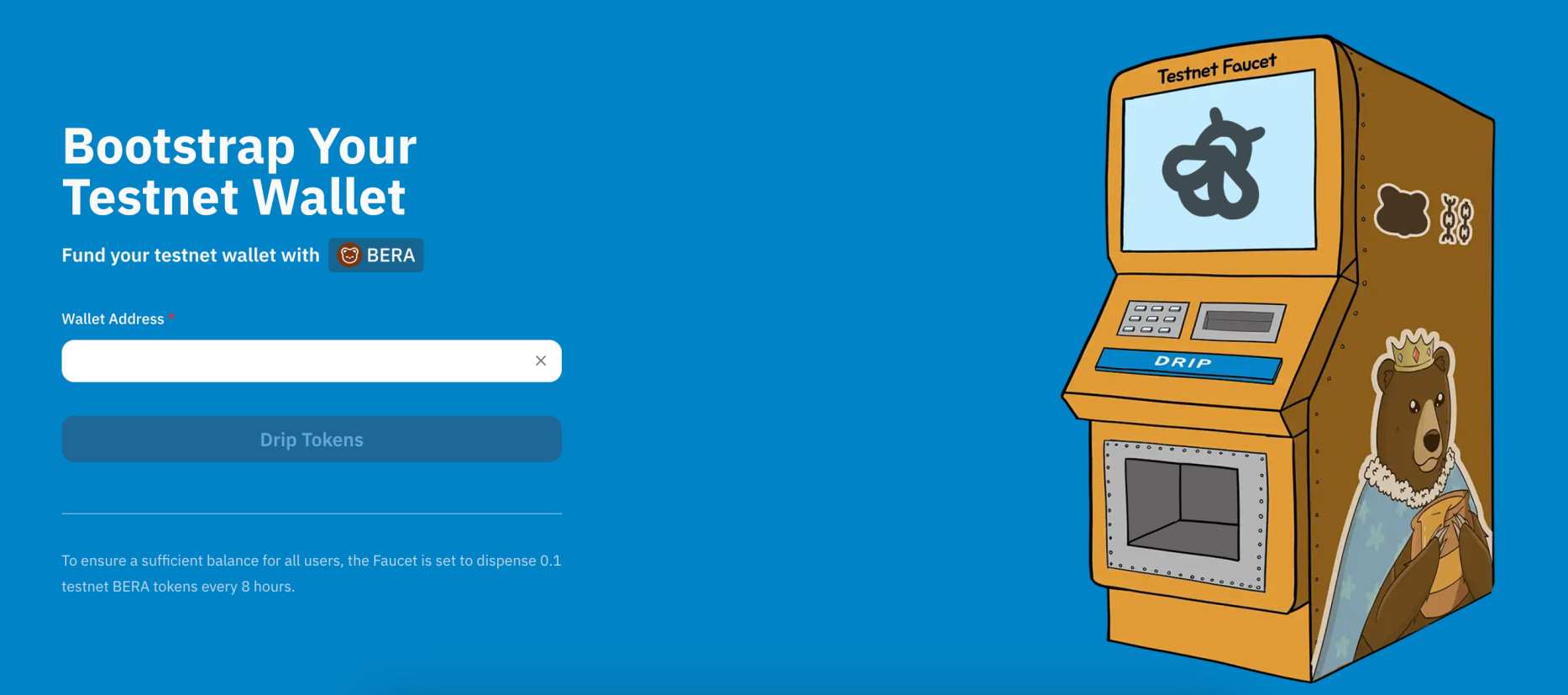

Step 2 – Claim Testnet Tokens (BERA) From the Faucet

You’ve now got a suitable Berachain wallet. The next step is to visit Berachain’s faucet page. Those new to faucets will need some background information. In simple terms, the best crypto faucets offer free Berachain testnet tokens when completing tasks, such as sharing social media tasks or playing games. Berachain’s faucet is considerably easier.

All that’s required is your wallet address. And, Berachain has partnered with four different faucet providers. This means you can quadruple the payout frequency. The amount of BERA received will vary depending on the faucet. So will the time limit. For example, Kodiak Faucet offers 1 BERA every 3 hours.

In contrast, QuickNode offers just 0.1 BERA every 12 hours. We found that faucet providers regularly adjust amounts and limits. However, you should attempt to maximize the rewards nonetheless. This will give you more BERA tokens to play around with, meaning you can complete a much wider range of tasks.

So, go back to the MetaMask wallet and copy your Berachain address. This is beneath the “Account 1” button. Then visit each faucet, paste that address, and wait a few seconds for the BERA tokens to arrive. Importantly, these tokens only exist within the testnet environment.

This means they can’t be transferred to redeemed. On the contrary, the tokens can only be used when accessing testnet products, such as staking, minting, and lending. We should also note that some faucet providers offer bonus payouts when sharing posts on social media. For instance, QuickNode is currently offering a 2x bonus when sharing the faucet drip on X.

Step 3 – Swap BERA Tokens on the BEX

You should now have some BERA testnet tokens in your MetaMask wallet balance. This means you can now start engaging with the Berachain ecosystem. Each completed task will likely go in your favor when Berachain eventually airdrops tokens. The first task to complete is a token swap on BEX.

BEX is Berachain’s native decentralized exchange. Similar to Uniswap (Ethereum), Pancakeswap (BNB Chain), and Raydium (Solana), BEX enables users to swap tokens without centralized order books. BEX uses the AMM system, ensuring smooth market conditions while retaining high security and anonymity.

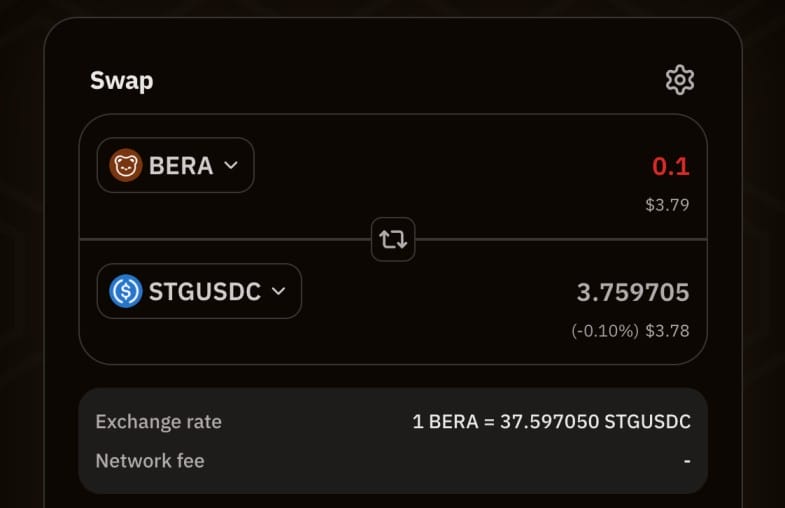

So, visit BEX, click the “Connect” button, and choose MetaMask. Now open MetaMask to confirm the wallet connection to BEX. Now click the “Swap Tokens” button. This will take you to the swapping interface. You must select “BERA” as the payment currency, as this is the only Berachain token you have in MetaMask.

You can, however, choose your preferred receiving token. Some of the options include HONEY, STGUSDC, DAI, WBTC, and WETH. You will also need to input the swap size. Keep this to a minimum – you’ll also need BERA for other testnet tasks. Finally, confirm the swap and reopen MetaMask to authorize the transaction.

The BERA tokens will be transferred from your MetaMask balance. They’ll then be swapped for the receiving tokens, which are then deposited into MetaMask. Consider making a few different swaps. For instance, BERA for STGUSDC, STGUSDC for HONEY, and HONEY back to BERA. The more swaps, the better – this will increase your network participation.

Step 4 – Provide Liquidity on BEX (And Earn BGT)

The next Berachain airdrop task to complete is to provide some liquidity. This will also be completed on BEX. Providing liquidity means you’re adding Berachain tokens to its decentralized exchange. This means that other people can use that liquidity to execute token swaps. Now, liquidity pools require two different tokens. This creates a trading pair.

What’s more, both tokens must be provided with an equal amount in fiat terms. For example, suppose you’re funding the HONEY/WETH pool. This enables users to swap HONEY for WETH or vice versa. You might add $1 worth of HONEY and $1 worth of WETH, meaning the total liquidity provided is $2.

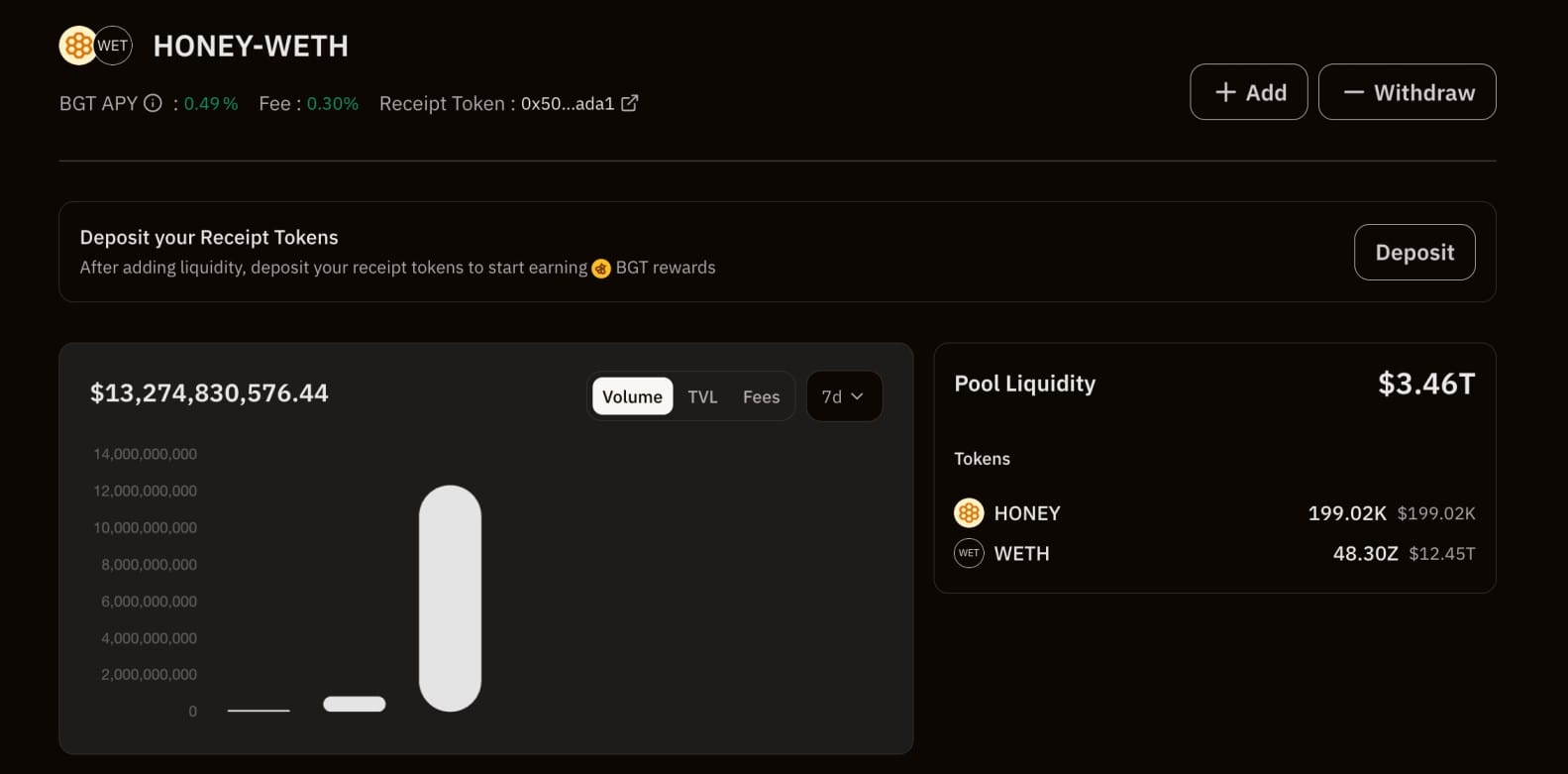

The exact number of tokens will depend on the exchange rate at the time. So, go back to BEX and click the “Pools” button. This will display a list of liquidity pools – click the one you want to engage with. Crucially, most pools allow you to earn BGT tokens when providing liquidity.

As mentioned, BGT is Berachains’s governance token. It enables holders to vote on key proposals suggested by the Berachain team. BGT can also be redeemed 1:1 with BERA. However, like Berachain’s other ecosystem tokens, any BGT you earn is only compatible with the testnet environment.

Nonetheless, each liquidity pool offers a different BGT APY (annual percentage yield). For example, the HONEY/WETH pool offers an APY of just 0.49%. In contrast, HONEY/WBTC pays over 2,300%. Some pools come without any APYs at all, meaning you won’t receive BGT.

You will, however, still be contributing to the Berachain network, so those liquidity pools will increase your engagement levels for the airdrop. What’s more, each liquidity pool has a different fee. This varies depending on the pool’s popularity. Fees are covered by your testnet tokens, so you won’t need to risk anything.

Once you’ve selected a liquidity pool, click the “Connect” button. Connect MetaMask to BEX like in the previous step. Then, specify the amount of liquidity you want to provide. It’s likely best to provide small amounts. This will enable you to cover multiple liquidity pools, helping you increase your engagement. You can withdraw liquidity from pools at any time.

Step 5 – Lend and Borrow Tokens on BEND

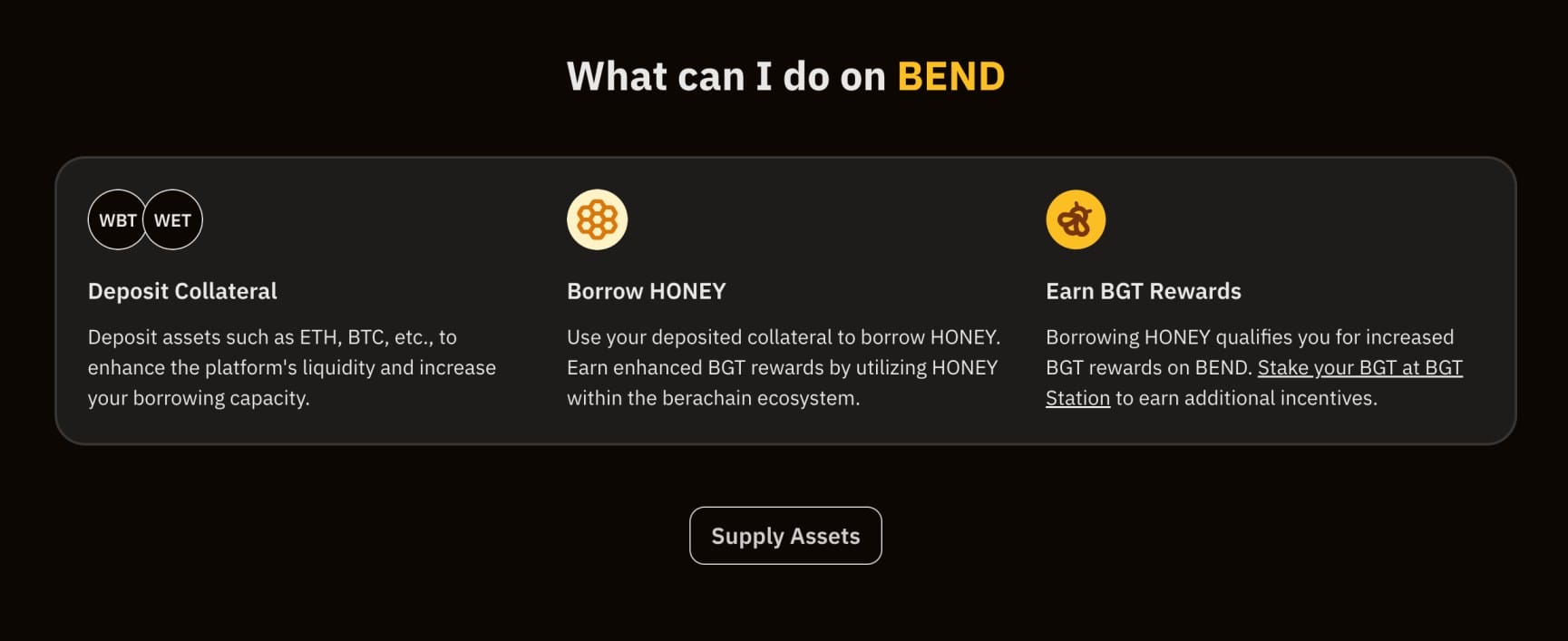

So far, you’ve performed some token swaps and added liquidity to a BEX pool. The next Berachain airdrop task is to visit BEND. This is Berachain’s lending and borrowing protocol. It enables lenders to earn passive yields on their Berachain tokens. Users can also borrow HONEY when providing collateral. As mentioned, HONEY is Berachain’s native stablecoin.

So, there are two parts to this step. First, you’re going to lend some tokens to BEND. After that, you’re going to take out a decentralized loan. Visit BEND and click the “Connect” button. Connect MetaMask like you did with the previous tasks. Then, decide which Berachain network token you want to supply.

Some of the options include BERA, HONEY, WETH, and WBTC. Each token comes with an APY, which determines how much interest you earn. This will be paid using the respective token. For example, you’ll passively earn BERA when supplying BERA. Confirm the transaction by opening MetaMask and providing authorization.

The tokens will then be transferred to the lending pool. Consider repeating this step for several different tokens to increase your engagement levels. The next step is to borrow some tokens from BEND. The good news is that the tokens you have already supplied can be used as collateral. The LTV (loan-to-value) will depend on the supplied and receiving tokens.

For example, suppose you supply $100 worth of BERA and want to borrow HONEY. We’ll say the LTV is 50%. This means you’d receive $50 worth of HONEY. Not only will you increase engagement when borrowing tokens, but you’ll also receive BGT. Those BGT tokens can be used on other Berachains dApps, meaning increased participation. More on that later.

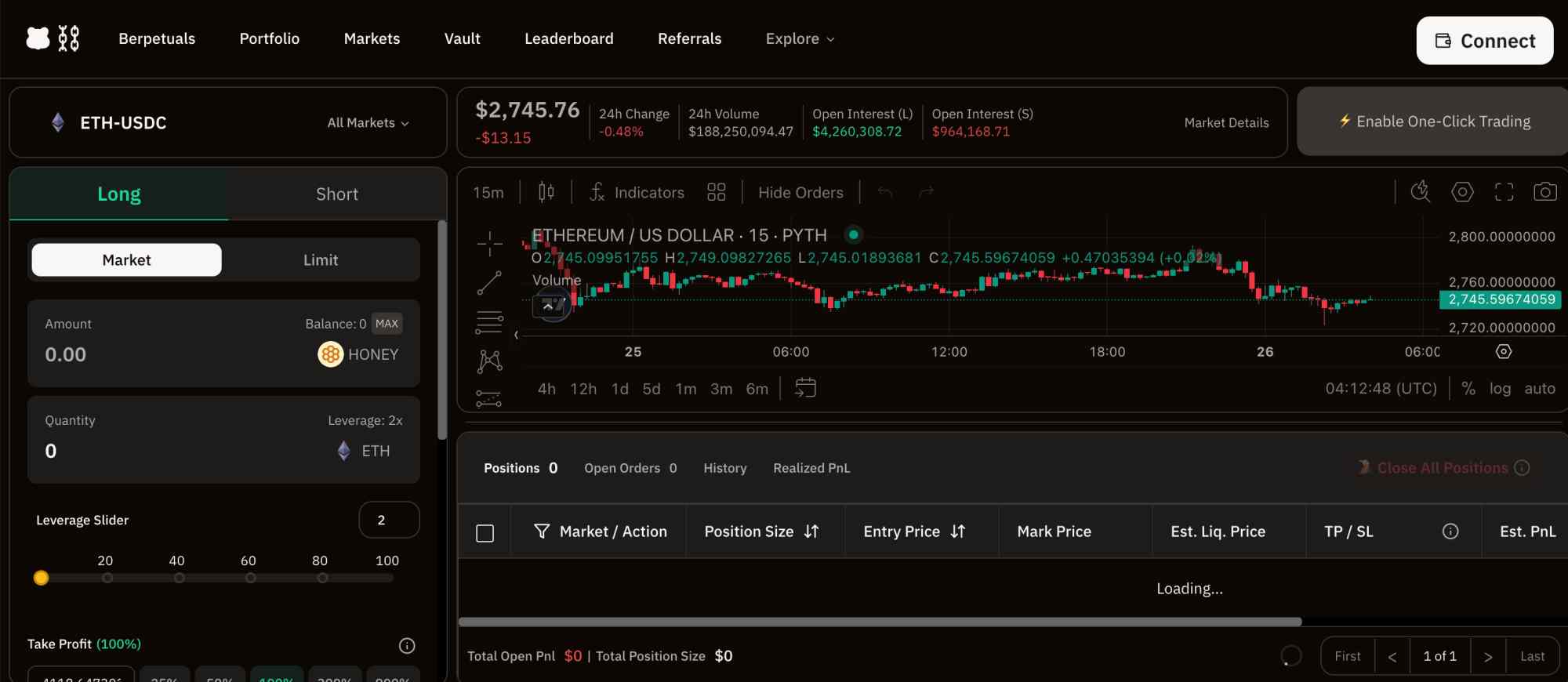

Step 6 – Trade Perpetual Futures on BERPS

The next step in this Berachain airdrop guide is to visit BERPS. This is Berachain’s native trading platform for perpetual futures. It currently supports four markets, BTC, ETH, ATOM, and TIA – all tradable against USDC. Similar to other perpetual futures platforms, BERPS offers high leverage of up to 100x.

This means a $1 position increases to $100 when maximized. Moreover, BERPS supports long and short trading, which is ideal for scalping, day trading, and other short-term strategies. Now, just like the other dApps discussed so far, BERPS is in the testnet environment.

This means you aren’t required to risk any money when trading perpetual futures. So, choose a perpetual market to trade, select from a long or short position, and confirm. Our suggestion is to enter and exit multiple trades across the four supported pairs. This will increase participation in the Berachain ecosystem, potentially meaning higher airdrop rewards.

Step 7 – Engage in the Berachain Governance Ecosystem

Governance sits at the heart of the Berachain ecosystem. It ensures that everyone has a voice. Anyone holding BGT tokens gets to vote on key network proposals. BGT holders can also delegate tokens to validators. These are people tasked with keeping the Berachain network decentralized, secure, and transparent.

Before getting started, make sure you have some BGT tokens in your MetaMask wallet. You would have earned some BGT when providing liquidity on BEX in step 4. You also would have earned BGT in step 5 when borrowing tokens from BEND. Naturally, each task not only increases your participation levels but also the number of Berachain tokens earned.

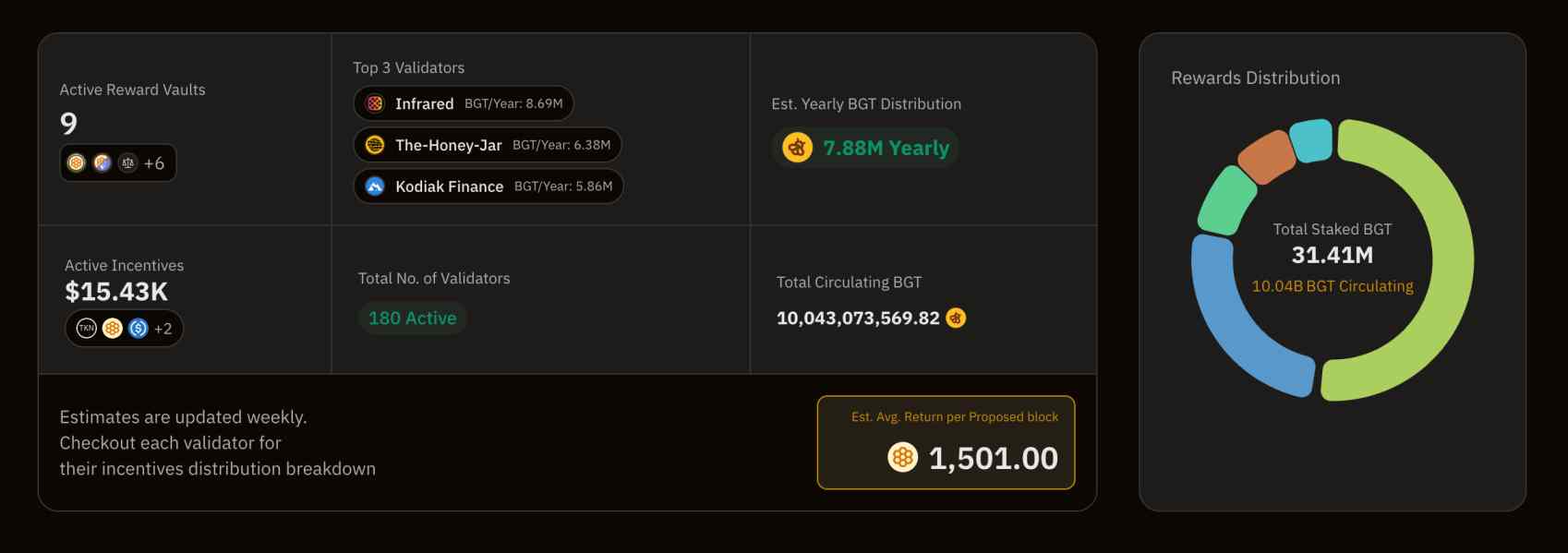

So, visit BGT Station, which is Berachain’s governance dApp. Click on the “Delegate” button followed by “Connect.” Connect MetaMask to reveal the list of available validators. Each delegator offers an APY of about 10%. The rewards are distributed in a specific token, depending on the delegator.

For example, Infrared, Kodiak Finance, and Beraland offer yields in HONEY, while Kingnodes offers USDC. Do note that each validator charges a commission. This will be deducted from your delegation rewards. Consider delegating tokens to multiple validators to increase engagement levels.

Rewards can be claimed at any time. Just click the “Rewards” button. BGT Station currently doesn’t have any proposals to vote on, but check back regularly. This will be another way to contribute to the Berachain ecosystem. BGT Station also offers a redemption tool, allowing users to swap BGT for BERA. However, like all existing dApps, swaps are purely for the testnet environment.

Step 8 – Stake BGT Tokens on Infrared

Infrared is a DeFi protocol built on the Berachain network. It specializes in “liquid staking.” This is ideal for earning passive rewards while still having access to liquidity. Plus, it’s an extra way to participate in the Berachain ecosystem, which potentially means higher airdrop rewards.

So, the first step is to visit Infrared and connect your MetaMask wallet. Next, you’ll need to swap some BGT for iBGT. Put simply, iBGT is Infrared’s native liquid token. It’s backed 1:1 by BGT, ensuring price stabilization and trust. Once you’ve got iBGT, you’ll have two options. Most people will immediately stake iBGT.

This is because the staking pool is currently offering APYs of over 1,300%. The other option is to use iBGT within the Berachain ecosystem. This will enable you to access other dApp services, such as liquidity mining and minting. The iBGT tokens can be redeemed back for BGT at any time. No lock-up periods are in place.

Step 9 – Mint HONEY by Swapping Stablecoins

The next step in this Berachain airdrop guide allows you to “Mint” HONEY. We’ve established that HONEY is Berachain’s native stablecoin. It doesn’t currently trade on exchanges, just like BERA and BGT. However, you can obtain HONEY by swapping it with another stablecoin. This includes USDT, DAI, or STGUSDC.

Crucially, this ensures that HONEY is backed like-for-like by established and reputable stablecoins. This means that it shouldn’t have any issues retaining its value to $1. So, if you’re looking to maximize the potential airdrop rewards, HONEY minting is a great option. However, just remember that you’ll need an accepted stablecoin in your MetaMask wallet.

Otherwise, you won’t be able to mint HONEY. Those wishing to proceed can visit the Berachain website and click “Honey” underneath “Explore.” Then, choose which stablecoin you want to use, alongside the number of tokens. Connect MetaMask to the platform and complete the minting process.

Do note you can redeem your original stablecoins at any time. In doing so, the respective HONEY tokens will be burned and removed from the circulating supply. The main drawback is that static fees of 0.5% apply, not only when minting HONEY but redeeming the stablecoins too.

Step 10 – Explore and Engage With Other Berachain dApps

Looking to seriously improve your chances of getting a huge Berachain airdrop? We’d strongly suggest engaging with as many Berachain dApps as practically possible. There are currently over 160 dApps on the Berachain network. An impressive feat considering the ecosystem is still in its testnet environment and without any tokens trading in the public domain.

Some of the most popular dApp categories include:

- Bridging tools

- Real-world assets (RWA)

- Custody

- DeFi

- GameFi

- SocialFi

- NFTs

- BetFi

- Stablecoins

- Decentralized autonomous organization (DAO)

- Wallets

Now, it’s best to engage with dApps that support the Berachain tokens you’re currently holding. For example, if you’ve accumulated a large number of BERA, look for different dApps to allocate those BERA tokens. That said, you can always use BEX to swap tokens for the ones you need.

Although this will attract a small trading fee, each swap further increases your contribution to the network. Just make sure you’re only using dApps that are listed on the Berachain website. These have been prevented for security and legitimacy.

Recommended Actions and Best Practices For The Berachain Airdrop

We’ve covered various ways to potentially qualify for the Berachain airdrop. We’re now going to discuss some best practices. Not only to maximize your earnings but also to stay safe and efficient.

Use a Separate MetaMask Wallet

We strongly suggest creating a separate MetaMeta wallet specifically for the Berachain airdrop tasks. This will ensure your airdrop efforts are easily tracked and monitored. This means that the separate wallet will exclusively store Berachain tokens.

It takes seconds to create a separate wallet, known as an “Account.” Open MetaMask and click on “Account 1,” followed by “Add Account or Hardware Device.” Then click “Add a New Account” and give it a name.

Do note that the newly created MetaMask wallet will have the same password and backup passphrase. Therefore, follow best practices to keep the wallet safe and secure.

Keep a Log of Berachain Tasks

We’ve explained that the more Berachain tasks completed, the better. Each task will increase your engagement levels. And, like many other crypto airdrops, increased engagement often means more tokens. However, the sheer number and diversity of available tasks can be cumbersome to track.

This is why it’s a great idea to make a journal. This will ensure you stay on track and can independently verify what tasks you’ve completed if needed. That said, each task will automatically be represented by a Berachain smart contract, so participation can be verified on the blockchain nonetheless.

Maximize the Faucet Rewards

Berachain faucets enable you to earn free testnet tokens. Those tokens, distributed in BERA, can be used within the Berachain ecosystem. This means you can increase your holdings and engagement levels without risking any money. Therefore, aim to maximize the faucet rewards.

Now, each faucet has its own terms and limits. For example, we mentioned that Kodiak Faucet offers 1 BERA token every 3 hours. In theory, this means you can claim 6 BERA tokens every day. However, the actual amount will realistically be less, factoring in sleep and work.

Some participants will leverage automated bots for this step. We strongly advise against this practice. Berachain could have protocols in place to detect bot usage. This could invalidate your airdrop eligibility. So, the best practice is to create a workflow outlining when to make faucet claims. This should align with your usual day-to-day schedule.

Interact With the Berachain Community

History suggests that airdrops often reward users who engage with the wider community. We’d suggest doing the same with fellow Berachain users. First, visit and follow the Berachain X page. You’ll be joining almost 920,000 like-minded community members. Consider frequently liking, sharing, and replying to Berachain posts.

Next, visit the Berachain Discord server. Regularly log in and engage with other users. You can then visit and join the Berachain Telegram group.

We’d suggest creating a separate workflow target for each of Berachain’s socials. For example, you might check in once per week to like and comment on a bunch of posts. This will also ensure you’re updated whenever key project developments are announced – especially regarding the airdrop campaign.

Only Engage With Legitimate Berachain dApps

You must stay safe when contributing to the Berachain ecosystem. Particularly when using third-party dApps to increase your airdrop engagement levels. At a minimum, ensure that you’re only using dApps that are listed on the Berachain website.

As mentioned, these dApps are endorsed and pre-vetted, so they’re considered secure. In addition, always double-check wallet connection requests. This will ensure you’re connecting the wallet to the intended dApp.

Have an Exit Strategy Once Bera is Listed on Exchanges

We’ve explained how to maximize your potential airdrop rewards, and what best practices to follow to ensure safety. There’s one more step to consider – the exit strategy. After all, you’re dedicating time and effort when completing airdrop tasks. Therefore, profit maximization should be the end goal.

This means selling BERA tokens at the right time, although this is easier said than done.

- For example, consider the Bonk airdrop from December 2022.

- There was an initial price spike once Bonk began trading on exchanges, before a broader market sell-off.

- The Bonk price remained sideways for the next 9 months, before going parabolic.

- Airdrop participants holding Bonk today are 20,000% up from the initial listing price.

- This is the case even though Bonk now trades 55% below all-time highs.

In contrast, consider the Arbitrum airdrop. from early 2023. CoinMarketCap data shows that Arbitrum was listed at $1.32. Today, Arbitrum trades at just $0.60. It also trades 75% below all-time highs, which were hit in January 2024. This extreme volatility means knowing when to cash out can be challenging. This is why creating an exit strategy and sticking to it is so important.

The Berachain airdrop could be a huge success, with participants earning free BERA tokens without risking money. However, participants should take a diversified approach to the airdrop. This means dedicating time and effort to multiple airdrop campaigns. After all, Berachain hasn’t released its airdrop criteria.

This is almost certain to come once the testnet period ends. This means there’s no guarantee that your efforts will be adequately rewarded. With this in mind, we’ve created a comprehensive guide on the best crypto airdrops. It’s regularly updated to ensure participants get in at the earliest stage.

If you’re strapped for time, one of the standout airdrops right now is being offered by Best Wallet. This is a non-custodial wallet doubling up as a decentralized exchange. A huge range of features are being worked on, including derivative trading, portfolio management, MEV protection, custom order types, and advanced anti-fraud tools.

The Best Wallet airdrop is simple to participate in:

- First, visit the Best Wallet website, click “Airdrop,” and connect an X account.

- Then, it’s just a case of engaging with Best Wallet by liking and sharing posts.

- Each completed task earns points. There are also daily tasks that allow you to maximize your potential earnings.

- Points will eventually be converted to airdrop rewards, distributed in BEST tokens.

Conclusion

In summary, the Berachain airdrop continues to generate hype in the crypto community. Although exact details haven’t been announced by the Berachain team, “incentivization” has been hinted at as the core eligibility requirement.

This means that engaging with the Berachain ecosystem will be the most effective way of earning BERA tokens. Plenty of tasks are available, from token swaps and staking to governance, delegation, and providing liquidity.

FAQs

Is the Berachain airdrop confirmed?

Berachain’s co-founder, “Smokey the Bera,” has confirmed

on X that the “testnet is incentivized”. This suggests the airdrop campaign is confirmed, and BERA rewards will be based on ecosystem contribution.

How big will the Berachain airdrop be?

The exact details of the Berachain airdrop distribution haven’t been announced. Further information will likely be provided once the testnet period is over.

Is it too late to qualify for the Berachain airdrop?

No, it’s not too late to qualify for the Berachain airdrop. You still have time to complete as many tasks as you can, such as swapping tokens on BEX and minting HONEY.

What should I do to get the Berachain airdrop?

The best strategy is to engage with Berachain dApps, allowing you to increase your contribution levels. Get started by using the Berachain faucet to earn free testnet tokens, and use those tokens to swap, mint, stake, and more.

When is Berachain airdrop?

The Berachain airdrop date hasn’t been announced yet. We’d suggest focusing on network engagement for now – further airdrop details will be provided in due course.

References